Reverse Mortgage vs. HECM for Purchase: Unlocking Your Home’s Equity

Reverse Mortgage vs. HECM for Purchase: Unlocking Your Home’s Equity

Disclaimer: While this article provides general information, it’s essential to consult with a financial advisor before making any decisions about your finances. David Blatt is an expert in Reverse Mortgages and HECM for Purchase. Please contact David if you have any questions or would like a free estimate.

Are you a senior homeowner looking to unlock the equity in your home? You’ve likely come across the terms “reverse mortgage” and “HECM for Purchase.” While these options might sound similar, there are key differences that can impact your financial situation. Let’s break down the distinctions between the two.

Understanding Reverse Mortgages

A reverse mortgage is a financial tool that allows homeowners aged 55 or older to convert a portion of their home’s equity into cash. This cash can be received as a lump sum, line of credit, or monthly payments. The loan balance grows over time, and the loan becomes due when the homeowner sells the property, moves out permanently, or passes away.

HECM for Purchase: A Unique Option

A Home Equity Conversion Mortgage (HECM) for Purchase is a specific type of reverse mortgage that allows seniors to purchase a new home using the proceeds from the reverse mortgage. This option can be particularly attractive for those looking to downsize or relocate to a more suitable residence.

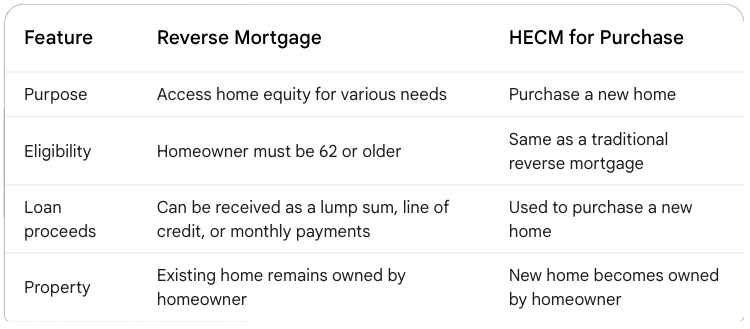

Key Differences Between Reverse Mortgages and HECM for Purchase

Benefits of a HECM for Purchase

- Avoids double closing costs: By using a HECM for Purchase, you can eliminate the costs associated with selling your current home and purchasing a new one.

- Potential for lower housing costs: Downsizing to a smaller home can often lead to lower property taxes, utilities, and maintenance costs.

- Flexibility: You can choose the type of reverse mortgage that best suits your needs, such as a lump sum or line of credit.

Important Considerations

While a HECM for Purchase can be a valuable tool, it’s essential to weigh the pros and cons carefully. Consider factors such as:

- Property values: Ensure that the new home’s value is sufficient to support the reverse mortgage.

- Long-term plans: Evaluate your housing needs and preferences for the future.

- Financial situation: Assess your overall financial health and income sources.

- Counseling: Seek guidance from a HUD-approved housing counselor to understand the implications of a reverse mortgage.

Disclaimer: Reverse mortgages are complex financial products. It’s crucial to consult with a qualified financial advisor to determine if a reverse mortgage or HECM for Purchase is right for your situation.

By understanding the differences between reverse mortgages and HECMs for Purchase, you can make informed decisions about how to leverage your home equity to meet your retirement goals.

Would you like to know more about the specific terms and conditions of reverse mortgages or HECMs for Purchase? Contact David Blatt your Reverse Mortgage Specialist at 800-318-8000 or send him an email using our contact form.